- Vendor

- Microsoft

- VMware

- MuleSoft

- Splunk

- Oracle

- CompTIA

- Fortinet

- Cisco

- EC-Council

- ISC2

- Paloalto-Networks

- HP

- IBM

- Salesforce

- PMI

- Amazon

- LPI

- Check-Point

- iSQI

- Juniper

- AZ-900 Practice Test

- MB-901 Practice Test

- AZ-300 Practice Test

- MS-900 Practice Test

- MS-700 Practice Test

- MD-100 Practice Test

- AZ-400 Practice Test

- mb-200 Practice Test

- 70-764 Practice Test

- MD-101 Practice Test

- AZ-301 Practice Test

- az-500 Practice Test

- AZ-204 Practice Test

- 70-741 Practice Test

- MS-101 Practice Test

- 70-740 Practice Test

- AZ-104 Practice Test

- AZ-103 Practice Test

- 70-742 Practice Test

- MS-100 Practice Test

- 2V0-21.19 Practice Test

- 2V0-21.19D Practice Test

- 2V0-01.19 Practice Test

- 3v0-624 Practice Test

- 1V0-701 Practice Test

- 2V0-761 Practice Test

- 2V0-622 Practice Test

- 2V0-61.19 Practice Test

- 2V0-621 Practice Test

- 2V0-642 Practice Test

- 3V0-21.18 Practice Test

- 2V0-41.20 Practice Test

- 2V0-21.20 Practice Test

- 2V0-751 Practice Test

- 2V0-621D Practice Test

- 3V0-42.20 Practice Test

- 2V0-31.20 Practice Test

- 2V0-21.20 Practice Test

- 2V0-41.20 Practice Test

- 2V0-21.20 Practice Test

- MCD-Level-1 Practice Test

- MCIA-Level-1 Practice Test

- MCPA-Level-1 Practice Test

- MCPA-Level-1-Maintenance Practice Test

- SPLK-1001 Practice Test

- SPLK-2002 Practice Test

- SPLK-1002 Practice Test

- SPLK-1003 Practice Test

- SPLK-3001 Practice Test

- SPLK-1005 Practice Test

- SPLK-2003 Practice Test

- SPLK-2001 Practice Test

- SPLK-5001 Practice Test

- 1z0-1054 Practice Test

- 1z0-1053 Practice Test

- 1z0-888 Practice Test

- 1z0-468 Practice Test

- 1z0-067 Practice Test

- 1z0-900 Practice Test

- 1Z0-809 Practice Test

- 1Z0-435 Practice Test

- 1z0-1042 Practice Test

- 1z0-808 Practice Test

- 1z0-1050 Practice Test

- 1z0-813 Practice Test

- 1z0-1064 Practice Test

- 1z0-060 Practice Test

- 1Z0-071 Practice Test

- 1z0-1048 Practice Test

- 1z0-1047 Practice Test

- 1Z0-062 Practice Test

- 1z0-083 Practice Test

- 1z0-1049 Practice Test

- N10-007 Practice Test

- XK0-004 Practice Test

- SY0-501 Practice Test

- 220-1001 Practice Test

- CS0-001 Practice Test

- 220-1002 Practice Test

- CAS-003 Practice Test

- PK0-004 Practice Test

- PT0-001 Practice Test

- jn0-361 Practice Test

- jn0-210 Practice Test

- N10-006 Practice Test

- SY0-601 Practice Test

- CS0-002 Practice Test

- CV0-002 Practice Test

- CAS-003 Practice Test

- PT0-001 Practice Test

- CS0-002 Practice Test

- N10-007 Practice Test

- 220-1002 Practice Test

- NSE4_FGT-6.0 Practice Test

- NSE7_EFW-6.0 Practice Test

- NSE4_FGT-6.2 Practice Test

- NSE4 Practice Test

- NSE7_EFW-6.2 Practice Test

- NSE8_810 Practice Test

- NSE5_FAZ-6.2 Practice Test

- NSE7_ATP-2.5 Practice Test

- NSE7 Practice Test

- NSE4_FGT-6.4 Practice Test

- NSE6_FWB-6.0 Practice Test

- NSE4_FGT-6.4 Practice Test

- NSE7_SAC-6.2 Practice Test

- NSE7_OTS-6.4 Practice Test

- NSE7_EFW-6.4 Practice Test

- NSE6_FNC-8.5 Practice Test

- NSE5_FSM-5.2 Practice Test

- NSE4_FGT-7.0 Practice Test

- NSE5_FAZ-6.4 Practice Test

- NSE7_SDW-6.4 Practice Test

- 200-301 Practice Test

- 350-401 Practice Test

- 300-410 Practice Test

- 700-905 Practice Test

- 300-475 Practice Test

- 352-001 Practice Test

- 300-735 Practice Test

- 010-151 Practice Test

- 700-765 Practice Test

- 300-715 Practice Test

- 300-415 Practice Test

- 200-901 Practice Test

- 350-901 Practice Test

- 300-430 Practice Test

- 810-440 Practice Test

- 350-701 Practice Test

- 300-820 Practice Test

- 300-730 Practice Test

- 300-435 Practice Test

- 600-601 Practice Test

- 312-50v10 Practice Test

- 412-79v10 Practice Test

- 312-38 Practice Test

- 312-50v11 Practice Test

- 212-89 Practice Test

- 312-50 Practice Test

- 312-85 Practice Test

- 312-49v10 Practice Test

- 312-50v12 Practice Test

- 712-50 Practice Test

- 312-39 Practice Test

- 212-82 Practice Test

- ECSAv10 Practice Test

- 312-49v9 Practice Test

- 312-50v13 Practice Test

- CCSP Practice Test

- CISSP Practice Test

- CISSP-ISSAP Practice Test

- CISSP-ISSEP Practice Test

- SSCP Practice Test

- CCSP Practice Test

- HCISPP Practice Test

- CAP Practice Test

- ISSMP Practice Test

- ISSEP Practice Test

- CSSLP Practice Test

- ISSAP Practice Test

- CC Practice Test

- PCNSE Practice Test

- PCNSA Practice Test

- PCNSE7 Practice Test

- PSE-Cortex Practice Test

- PCCET Practice Test

- PCCSE Practice Test

- NetSec-Pro Practice Test

- PSE-Strata-Pro-24 Practice Test

- HPE0-V14 Practice Test

- HP2-H82 Practice Test

- HPE2-K42 Practice Test

- HPE0-S56 Practice Test

- HPE0-J57 Practice Test

- HPE6-A70 Practice Test

- HPE2-E71 Practice Test

- hpe6-a41 Practice Test

- HPE6-A45 Practice Test

- HPE6-A82 Practice Test

- HPE2-T36 Practice Test

- HPE0-S57 Practice Test

- HPE0-P26 Practice Test

- HPE6-A47 Practice Test

- HPE0-S58 Practice Test

- HPE2-T37 Practice Test

- HPE0-S54 Practice Test

- HPE6-A73 Practice Test

- HPE6-A72 Practice Test

- HPE6-A78 Practice Test

- 1Y0-204 Practice Test

- C2150-606 Practice Test

- C1000-010 Practice Test

- C2150-609 Practice Test

- C1000-017 Practice Test

- C9510-418 Practice Test

- P9530-039 Practice Test

- C2090-558 Practice Test

- 1Y0-204 Practice Test

- C9510-401 Practice Test

- C1000-007 Practice Test

- C2090-616 Practice Test

- C2090-102 Practice Test

- C9560-503 Practice Test

- M2150-860 Practice Test

- C2010-555 Practice Test

- C2010-825 Practice Test

- C1000-118 Practice Test

- C2090-619 Practice Test

- C1000-056 Practice Test

- PDI Practice Test

- CRT-450 Practice Test

- ADM-201 Practice Test

- CRT-251 Practice Test

- Sharing-and-Visibility-Designer Practice Test

- Platform-App-Builder Practice Test

- Development-Lifecycle-and-Deployment-Designer Practice Test

- Integration-Architecture-Designer Practice Test

- ADM-201 Practice Test

- B2C-Commerce-Developer Practice Test

- Data-Architecture-And-Management-Designer Practice Test

- OmniStudio-Consultant Practice Test

- Identity-and-Access-Management-Designer Practice Test

- Experience-Cloud-Consultant Practice Test

- Marketing-Cloud-Email-Specialist Practice Test

- JavaScript-Developer-I Practice Test

- OmniStudio-Developer Practice Test

- Field-Service-Lightning-Consultant Practice Test

- Certified-Business-Analyst Practice Test

- DEV-501 Practice Test

- PMI-001 Practice Test

- PMI-ACP Practice Test

- CAPM Practice Test

- PMI-RMP Practice Test

- PMI-PBA Practice Test

- PMI-100 Practice Test

- PMI-SP Practice Test

- PgMP Practice Test

- PfMP Practice Test

- CPMAI_v7 Practice Test

- AWS-Certified-Cloud-Practitioner Practice Test

- AWS-Certified-Developer-Associate Practice Test

- AWS-Certified-Solutions-Architect-Professional Practice Test

- AWS-SysOps Practice Test

- AWS-Certified-DevOps-Engineer-Professional Practice Test

- AWS-Solution-Architect-Associate Practice Test

- AWS-Certified-Big-Data-Specialty Practice Test

- AWS-Certified-Security-Specialty Practice Test

- AWS-Certified-Advanced-Networking-Specialty Practice Test

- AWS-Certified-Security-Specialty Practice Test

- AWS-Certified-Developer-Associate Practice Test

- AWS-Certified-Solutions-Architect-Professional Practice Test

- AWS-Certified-DevOps-Engineer-Professional Practice Test

- AWS-Certified-Database-Specialty Practice Test

- DVA-C02 Practice Test

- AWS-Certified-Data-Analytics-Specialty Practice Test

- AWS-Certified-Data-Engineer-Associate Practice Test

- AWS-Certified-Machine-Learning-Specialty Practice Test

- 101-500 Practice Test

- 102-500 Practice Test

- 201-450 Practice Test

- 202-450 Practice Test

- 010-150 Practice Test

- 010-160 Practice Test

- 303-200 Practice Test

- 156-315.80 Practice Test

- 156-215.80 Practice Test

- 156-215.80 Practice Test

- 156-315.80 Practice Test

- 156-215.77 Practice Test

- 156-915.80 Practice Test

- JN0-102 Practice Test

- JN0-211 Practice Test

- JN0-662 Practice Test

- JN0-103 Practice Test

- JN0-648 Practice Test

- JN0-348 Practice Test

- JN0-230 Practice Test

- JN0-1301 Practice Test

- JN0-1332 Practice Test

- JN0-104 Practice Test

- JN0-682 Practice Test

- JN0-334 Practice Test

- JN0-363 Practice Test

- JN0-231 Practice Test

- JN0-664 Practice Test

- JN0-351 Practice Test

- JN0-683 Practice Test

- JN0-452 Practice Test

- JN0-460 Practice Test

- Categories

- Microsoft

- VMware

- MuleSoft

- Splunk

- Oracle

- CompTIA

- Fortinet

- Cisco

- EC-Council

- ISC2

- Paloalto-Networks

- HP

- IBM

- Salesforce

- PMI

- Amazon

- LPI

- Check-Point

- iSQI

- Juniper

- AZ-900 Dumps

- MB-901 Dumps

- AZ-300 Dumps

- MS-900 Dumps

- MS-700 Dumps

- MD-100 Dumps

- AZ-400 Dumps

- mb-200 Dumps

- 70-764 Dumps

- MD-101 Dumps

- AZ-301 Dumps

- az-500 Dumps

- AZ-204 Dumps

- 70-741 Dumps

- MS-101 Dumps

- 70-740 Dumps

- AZ-104 Dumps

- AZ-103 Dumps

- 70-742 Dumps

- MS-100 Dumps

- 2V0-21.19 Dumps

- 2V0-21.19D Dumps

- 2V0-01.19 Dumps

- 3v0-624 Dumps

- 1V0-701 Dumps

- 2V0-761 Dumps

- 2V0-622 Dumps

- 2V0-61.19 Dumps

- 2V0-621 Dumps

- 2V0-642 Dumps

- 3V0-21.18 Dumps

- 2V0-41.20 Dumps

- 2V0-21.20 Dumps

- 2V0-751 Dumps

- 2V0-621D Dumps

- 3V0-42.20 Dumps

- 2V0-31.20 Dumps

- 2V0-21.20 Dumps

- 2V0-41.20 Dumps

- 2V0-21.20 Dumps

- SPLK-1001 Dumps

- SPLK-2002 Dumps

- SPLK-1002 Dumps

- SPLK-1003 Dumps

- SPLK-3001 Dumps

- SPLK-1005 Dumps

- SPLK-2003 Dumps

- SPLK-2001 Dumps

- SPLK-5001 Dumps

- 1z0-1054 Dumps

- 1z0-1053 Dumps

- 1z0-888 Dumps

- 1z0-468 Dumps

- 1z0-067 Dumps

- 1z0-900 Dumps

- 1Z0-809 Dumps

- 1Z0-435 Dumps

- 1z0-1042 Dumps

- 1z0-808 Dumps

- 1z0-1050 Dumps

- 1z0-813 Dumps

- 1z0-1064 Dumps

- 1z0-060 Dumps

- 1Z0-071 Dumps

- 1z0-1048 Dumps

- 1z0-1047 Dumps

- 1Z0-062 Dumps

- 1z0-083 Dumps

- 1z0-1049 Dumps

- N10-007 Dumps

- XK0-004 Dumps

- SY0-501 Dumps

- 220-1001 Dumps

- CS0-001 Dumps

- 220-1002 Dumps

- CAS-003 Dumps

- PK0-004 Dumps

- PT0-001 Dumps

- jn0-361 Dumps

- jn0-210 Dumps

- N10-006 Dumps

- SY0-601 Dumps

- CS0-002 Dumps

- CV0-002 Dumps

- CAS-003 Dumps

- PT0-001 Dumps

- CS0-002 Dumps

- N10-007 Dumps

- 220-1002 Dumps

- NSE4_FGT-6.0 Dumps

- NSE7_EFW-6.0 Dumps

- NSE4_FGT-6.2 Dumps

- NSE4 Dumps

- NSE7_EFW-6.2 Dumps

- NSE8_810 Dumps

- NSE5_FAZ-6.2 Dumps

- NSE7_ATP-2.5 Dumps

- NSE7 Dumps

- NSE4_FGT-6.4 Dumps

- NSE6_FWB-6.0 Dumps

- NSE4_FGT-6.4 Dumps

- NSE7_SAC-6.2 Dumps

- NSE7_OTS-6.4 Dumps

- NSE7_EFW-6.4 Dumps

- NSE6_FNC-8.5 Dumps

- NSE5_FSM-5.2 Dumps

- NSE4_FGT-7.0 Dumps

- NSE5_FAZ-6.4 Dumps

- NSE7_SDW-6.4 Dumps

- 200-301 Dumps

- 350-401 Dumps

- 300-410 Dumps

- 700-905 Dumps

- 300-475 Dumps

- 352-001 Dumps

- 300-735 Dumps

- 010-151 Dumps

- 700-765 Dumps

- 300-715 Dumps

- 300-415 Dumps

- 200-901 Dumps

- 350-901 Dumps

- 300-430 Dumps

- 810-440 Dumps

- 350-701 Dumps

- 300-820 Dumps

- 300-730 Dumps

- 300-435 Dumps

- 600-601 Dumps

- 312-50v10 Dumps

- 412-79v10 Dumps

- 312-38 Dumps

- 312-50v11 Dumps

- 212-89 Dumps

- 312-50 Dumps

- 312-85 Dumps

- 312-49v10 Dumps

- 312-50v12 Dumps

- 712-50 Dumps

- 312-39 Dumps

- 212-82 Dumps

- ECSAv10 Dumps

- 312-49v9 Dumps

- 312-50v13 Dumps

- CCSP Dumps

- CISSP Dumps

- CISSP-ISSAP Dumps

- CISSP-ISSEP Dumps

- SSCP Dumps

- CCSP Dumps

- HCISPP Dumps

- CAP Dumps

- ISSMP Dumps

- ISSEP Dumps

- CSSLP Dumps

- ISSAP Dumps

- CC Dumps

- PCNSE Dumps

- PCNSA Dumps

- PCNSE7 Dumps

- PSE-Cortex Dumps

- PCCET Dumps

- PCCSE Dumps

- NetSec-Pro Dumps

- PSE-Strata-Pro-24 Dumps

- HPE0-V14 Dumps

- HP2-H82 Dumps

- HPE2-K42 Dumps

- HPE0-S56 Dumps

- HPE0-J57 Dumps

- HPE6-A70 Dumps

- HPE2-E71 Dumps

- hpe6-a41 Dumps

- HPE6-A45 Dumps

- HPE6-A82 Dumps

- HPE2-T36 Dumps

- HPE0-S57 Dumps

- HPE0-P26 Dumps

- HPE6-A47 Dumps

- HPE0-S58 Dumps

- HPE2-T37 Dumps

- HPE0-S54 Dumps

- HPE6-A73 Dumps

- HPE6-A72 Dumps

- HPE6-A78 Dumps

- 1Y0-204 Dumps

- C2150-606 Dumps

- C1000-010 Dumps

- C2150-609 Dumps

- C1000-017 Dumps

- C9510-418 Dumps

- P9530-039 Dumps

- C2090-558 Dumps

- 1Y0-204 Dumps

- C9510-401 Dumps

- C1000-007 Dumps

- C2090-616 Dumps

- C2090-102 Dumps

- C9560-503 Dumps

- M2150-860 Dumps

- C2010-555 Dumps

- C2010-825 Dumps

- C1000-118 Dumps

- C2090-619 Dumps

- C1000-056 Dumps

- PDI Dumps

- CRT-450 Dumps

- ADM-201 Dumps

- CRT-251 Dumps

- Sharing-and-Visibility-Designer Dumps

- Platform-App-Builder Dumps

- Development-Lifecycle-and-Deployment-Designer Dumps

- Integration-Architecture-Designer Dumps

- ADM-201 Dumps

- B2C-Commerce-Developer Dumps

- Data-Architecture-And-Management-Designer Dumps

- OmniStudio-Consultant Dumps

- Identity-and-Access-Management-Designer Dumps

- Experience-Cloud-Consultant Dumps

- Marketing-Cloud-Email-Specialist Dumps

- JavaScript-Developer-I Dumps

- OmniStudio-Developer Dumps

- Field-Service-Lightning-Consultant Dumps

- Certified-Business-Analyst Dumps

- DEV-501 Dumps

- PMI-001 Dumps

- PMI-ACP Dumps

- CAPM Dumps

- PMI-RMP Dumps

- PMI-PBA Dumps

- PMI-100 Dumps

- PMI-SP Dumps

- PgMP Dumps

- PfMP Dumps

- CPMAI_v7 Dumps

- AWS-Certified-Cloud-Practitioner Dumps

- AWS-Certified-Developer-Associate Dumps

- AWS-Certified-Solutions-Architect-Professional Dumps

- AWS-SysOps Dumps

- AWS-Certified-DevOps-Engineer-Professional Dumps

- AWS-Solution-Architect-Associate Dumps

- AWS-Certified-Big-Data-Specialty Dumps

- AWS-Certified-Security-Specialty Dumps

- AWS-Certified-Advanced-Networking-Specialty Dumps

- AWS-Certified-Security-Specialty Dumps

- AWS-Certified-Developer-Associate Dumps

- AWS-Certified-Solutions-Architect-Professional Dumps

- AWS-Certified-DevOps-Engineer-Professional Dumps

- AWS-Certified-Database-Specialty Dumps

- DVA-C02 Dumps

- AWS-Certified-Data-Analytics-Specialty Dumps

- AWS-Certified-Data-Engineer-Associate Dumps

- AWS-Certified-Machine-Learning-Specialty Dumps

FPC-Remote Dumps

FPC-Remote Free Practice Test

APA FPC-Remote: Fundamental Payroll Certification

- (Topic 1)

What is the purpose of Form I-9?

Correct Answer:

D

Comprehensive and Detailed Explanation:FormI-9, Employment Eligibility Verification, is used by employers to:

✑ Verify the identity of newly hired employees

✑ Ensure employees are legally authorized to work in the U.S.

✑ Prevent illegal employment practices

✑ Option A (Request an ITIN)is incorrect because anITIN (Individual Taxpayer Identification Number)is requested usingForm W-7, not I-9.

✑ Option B (Determine FIT withholding)is incorrect becauseForm W-4is used for federal income tax withholding, not Form I-9.

✑ Option C (Summarize taxable wages)is incorrect becauseForm W-2summarizes

taxable wages. Reference:

U.S. Citizenship and Immigration Services (USCIS) – Form I-9 Instructions Payroll.org – Employment Eligibility Verification Guide

- (Topic 2)

Under the FMLA, employers MUST maintain related leave records for how many years?

Correct Answer:

B

✑ The Family and Medical Leave Act (FMLA)requires employers to keepFMLA- related records for at least 3 years.

✑ These records include:

✑ The DOL may audit these records to ensure FMLA compliance. References:

✑ FMLA Recordkeeping Requirements (DOL)

✑ Payroll Record Retention Guidelines (Payroll.org)

- (Topic 1)

Based on the following information, using the percentage method, calculate the employee's net pay:

Correct Answer:

B

Comprehensive and Detailed Explanation:Using theIRS Percentage MethodforMarried Filing Jointly (2019 W-4):

✑ Calculate taxable wages:

✑ Federal Income Tax (from IRS tax tables):

✑ Social Security Tax (6.2%):

✑ Medicare Tax (1.45%):

✑ Other deductions: Total Taxes and Deductions:

* 216.20+155.00+36.25+100.00=507.45216.20 + 155.00 + 36.25 + 100.00 = 507.45216.20+155.00+36.25+100.00=507.45

Net Pay Calculation:

* 2,500.00507.45=1,730.362,500.00 - 507.45 = 1,730.362,500.00507.45=1,730.36

Thus, the correct answer isB. $1,730.36. Reference:

IRS Publication 15-T – Federal Income Tax Withholding Methods Payroll.org – Net Pay Calculation Guide

- (Topic 2)

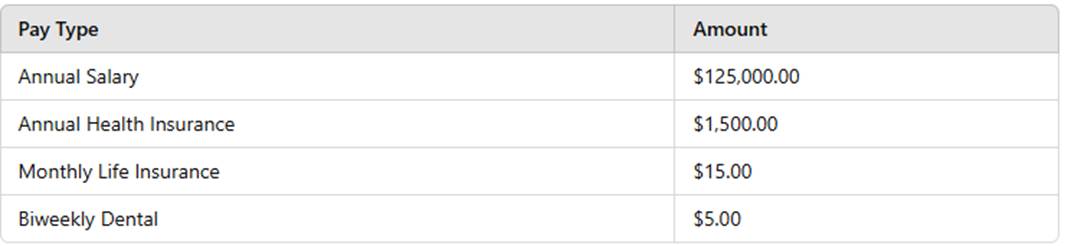

Based on the following Section 125 Cafeteria Plan contributions, calculate the employee??sbiweekly deductions.

Correct Answer:

A

✑ Health Insurance (Biweekly) = ($1,500 ?? 26) = $57.69

✑ Life Insurance (Biweekly) = ($15 ?? 12 ?? 26) = $6.92

✑ Dental Insurance = $5.00

✑ Total Biweekly Deduction = $57.69 + $6.92 + $5.00 = $69.61 References:

✑ IRS Section 125 Cafeteria Plan Rules

- (Topic 2)

Which of the following data elements is needed to calculate an employee??s net pay from gross pay?

Correct Answer:

D

✑ Withholding status (D) affects federal income tax deductionsand is essential for calculating net pay.

✑ Rate of pay (A), hours worked (B), and shift differentials (C) impact gross pay but

NOT net pay calculation. References:

✑ IRS Form W-4 Withholding Guidelines

✑ Payroll Calculation Standards (Payroll.org)