- (Topic 1)

Payroll standard operating procedures should be updated no less frequently than:

Correct Answer:

C

Comprehensive and Detailed Explanation:PayrollStandard Operating Procedures (SOPs)must beregularly updatedto maintain compliance and accuracy.

✑ Best practice is to update SOPs whenever workflows change(Option C).

✑ Option A (Annually)is incorrect becausewaiting a full yearcould lead to outdated procedures.

✑ Option B (Quarterly)is incorrect unless payroll processes are highly dynamic.

✑ Option D (When management changes)is incorrect becauseprocesses may change independently of leadership changes.

Reference:

Payroll.org – Payroll Policies and Procedures Best Practices IRS – Payroll Compliance Guidelines

- (Topic 2)

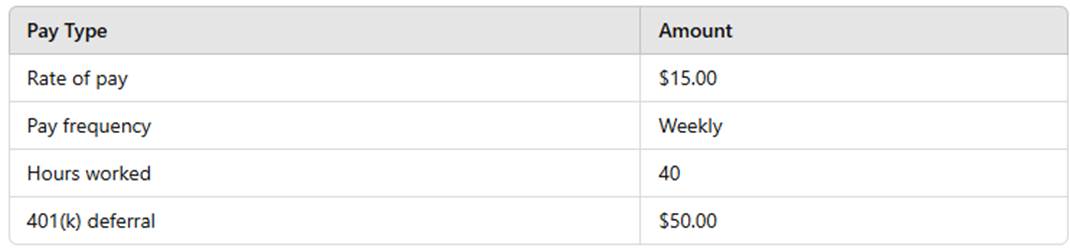

Using the wage bracket method, calculate the employee??s net pay. The employee??s W-4 was completed in 2019 or earlier.

Correct Answer:

B

✑ Gross pay:$15 ?? 40 = $600.00

✑ 401(k) deduction:$50.00(Pre-tax)

✑ FITW, Social Security (6.2%), Medicare (1.45%)applied

✑ Using the IRS Wage Bracket Method, net pay is $651.45 References:

✑ IRS Publication 15-T (Federal Income Tax Withholding Tables)

- (Topic 1)

All of the following objectives are included in the operations of a Payroll DepartmentEXCEPT:

Correct Answer:

C

Comprehensive and Detailed Explanation:ThePayroll Department??s key functionsinclude:

✑ Tax reporting (Option A)– Payroll ensures accurateIRS and state tax reporting.

✑ Cost savings (Option B)– Payroll manages efficiency, compliance, and automation toreduce costs.

✑ Reporting to management (Option D)– Payroll provides financial reports and insights tocompany leadership.

However,giving tax advice (Option C) is NOT a function of payroll. Payroll professionalscalculate and withhold taxesbut do notprovide tax planning adviceto employees.

Reference:

Payroll.org – Payroll Department Responsibilities IRS – Employer??s Responsibilities for Payroll Taxes

- (Topic 1)

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

Correct Answer:

B

Comprehensive and Detailed Explanation:Using theIRS Supplemental Wage Method, theflat tax rateof22%applies tobonuses:

✑ Federal Income Tax:

✑ Social Security Tax:

✑ Medicare Tax:

✑ State Income Tax: Total Taxes Withheld:

A white paper with black text

AI-generated content may be incorrect.

- (Topic 2)

The process used to verify and validate payroll system edits or warnings is called:

Correct Answer:

B

✑ Balancing and reconciliationensures payroll data isaccurate, consistent, and matches financial records.

✑ Gap analysis(A) is used to compare actual vs. expected performance.

✑ Evaluating system performance(C) focuses on efficiency, not data verification.

✑ Periodic auditing (D)is important but not the primary method of payroll validation. References:

✑ Payroll Balancing & Reconciliation Guidelines (Payroll.org)